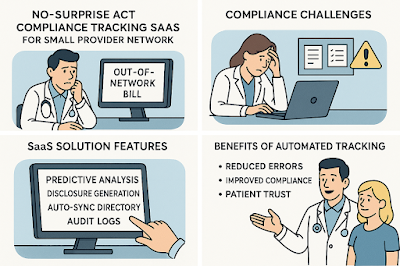

No-Surprise Act Compliance Tracking SaaS for Small Provider Networks

No-Surprise Act Compliance Tracking SaaS for Small Provider Networks

I still remember the first time a patient called, furious about an "out-of-network" bill they had no idea was coming.

As a small provider, I felt helpless.

That was the wake-up call—we needed help staying compliant, fast.

The healthcare billing landscape in the U.S. has always been a maze of codes, payer rules, and policy exceptions.

But with the introduction of the No Surprises Act in 2022, small healthcare providers now face a new level of scrutiny—especially when it comes to ensuring billing transparency and compliance.

For large hospitals with compliance departments and robust legal teams, this might be manageable.

But what about the local orthopedist with 12 staff members?

The dentist in a multi-specialty practice?

This is where SaaS tools built for No-Surprise Act compliance come in.

They're not just helpful—they're survival tools.

📌 Table of Contents

- Overview of the No Surprises Act

- Challenges Faced by Small Provider Networks

- Must-Have Features in a No Surprises Act Compliance Software for Healthcare Billing

- Real-World SaaS Tools in the Market

- Benefits of Automated Compliance Monitoring

- Frequently Asked Questions

- Final Thoughts

🩺 What is the No Surprises Act?

The No Surprises Act is a federal law enacted to protect patients from unexpected out-of-network medical bills—particularly during emergency care or when patients unknowingly receive services from an out-of-network provider at an in-network facility.

It demands clear cost estimates and disclosures before treatment and mandates provider directories to be up-to-date.

Violations aren't just a slap on the wrist; they can lead to penalties and significant reputational damage.

🚧 Compliance Challenges for Small Providers

Small networks face a unique set of hurdles when it comes to compliance:

• Limited staff trained in legal compliance.

• Manual billing systems prone to errors.

• Outdated directory information.

• Disconnected EHR and billing platforms.

Let’s be honest, a dentist or family practitioner didn’t go into medicine to become a compliance officer.

But with thousands of dollars on the line per violation, ignoring compliance isn't an option.

🧩 Must-Have Features in a No Surprises Act Compliance Software for Healthcare Billing

A good compliance tracking tool should feel less like a tax form and more like a well-trained assistant.

Here’s what to look for:

1. Predictive Billing Analysis: Tools that flag likely No-Surprise Act violations before bills are submitted.

2. Integrated Patient Disclosure: Automated generation of Good Faith Estimates that can be sent via email or patient portal.

3. Provider Directory Auto-Sync: Real-time updates to insurance directory listings to avoid mismatches.

4. Legal Language Templates: Pre-approved compliance language for consent forms and estimate disclosures.

5. Audit Log Storage: Immutable logs of disclosures and communications to protect in case of legal challenges.

📊 Real-World SaaS Tools in the Market

Here are three SaaS platforms helping small providers remain compliant:

ClearHealth Costs: A platform offering customizable Good Faith Estimate generators and patient engagement tools.

HealthSherpa for Providers: Originally a healthcare exchange tool, it's now equipped with compliance modules.

TrueClaim: Offers real-time monitoring of claims, estimates, and patient communication for law compliance.

🎯 Benefits of Automated Compliance Monitoring

The ROI is clear: prevention costs less than penalties.

Compliance tools not only prevent fines but also boost trust with patients and insurers.

Plus, they help providers sleep better at night—knowing they’re protected.

Additional benefits include:

• Reduced claim denials.

• Higher patient satisfaction.

• Fewer legal headaches.

• Documented audit trails for any regulator inquiry.

🧐 Frequently Asked Questions

Q: Is a SaaS solution mandatory under the No Surprises Act?

A: While not required by law, it drastically reduces the risk of non-compliance and billing errors.

Q: How much does a compliance tracking SaaS cost for a small provider?

A: Prices vary, but most offer monthly subscriptions between $50–$200 depending on features.

🧾 Final Thoughts: SaaS Isn't Optional—It's Essential

If you're a small provider, the No Surprises Act can seem like yet another regulation to wrangle.

But with the right SaaS tools, it's actually a chance to modernize your billing, build patient trust, and avoid costly errors.

In a post-pandemic world where every dollar and every review matters, compliance isn’t just about law—it’s about brand.

Key Terms: No Surprises Act, healthcare SaaS compliance, Good Faith Estimates, provider directories, medical billing transparency